Introduction

Debt collection section is an additional module of the Perfect Gym system. It provides key information on members' overdue payments, due dates and debt process stages. It also offers tools that are helpful in successful overdue payment collection.

Debt collection is an additionally paid module so contact you PG sales representative if you wish to use it.

This module is divided into collection steps. Each step is different according to your needs, e.g. grouping debtors based on debt level, current status, debt amount, already completed debt collection steps, or days past due - all those settings depend on you and your business rules.

- This article is for all users who would like to acquire knowledge on what PG Debt Collection feature has to offer and how to set up the basic configuration. At this moment, the full configuration will require the Perfect Gym Support Team's help with some steps.

- This module is only designed for club who do not use the family payment system. This treats all users within the family as individual users and will not group up the family together.

- This module cannot be used with the Course/Group module.

- At the end of his article, you will be able to configure rules that automate debt collection process for your company and you will learn about the possible options that might be useful for this process.

Before you start

Debt Collection feature is based on Automation rules, therefore the company must have Automation enabled and configured. You can find more information about that module in this article and on its configuration, here.

Contact PG Support in order to plan the implementation of the Debt collection module. They need to enable this setting on your database: Feature.DebtCollection.IsEnabled. They'll also need to run these tasks: ExitDebtCollectionRecurringTask and AutomationCenter.numberOfDaysInDebtIncreasedEventTriggerRecurringTask

Self-configuration of this module may lead to unexpected notifications sent to your club members!

Process Overview

In our solution, we use a member approach to process debtors. That means debt collection process is created per user not per transaction, based on individual balance of each member. When a member becomes a debtor, only one debt collection process is being opened, even if a club member has multiple overdue transactions. A new process for the same user can start only when the old one is closed and that happens when the member paid the debt. As a consequence club members cannot be in multiple debt collection processes at the same time.

- The first step is to define the debt collection stages. The number of stages, their names, and the meaning of each stage is up to your business needs. In PGM you can use a predefined up to 4-stages debt collection process.*

- Once the stages for the debt collection process are defined, the new rules in Automation Center can be added. Each stage needs a separate rule for each action.

If your business requires a custom-designed debt collection process with more than 4 stages, please contact our Support Team. At the moment, stage definition is held in the database, so the Clubs are not able to do that by themselves. Please, be aware that such customization will be treated as a Professional Service.

Available actions:

- Change Debt Collection Stage

- Add Contract Transaction

- Cancel Contracts

- Notification

- Exclude a member from recurring payments

- Remove an exclusion member from recurring payments

- Add a note to the user (with an option to block access to the club - check more about User notes here)

- Tag (check article about Tags here)

- Block contract payments

- Unblock contract payments

For example, if your company has 3 debt stages, you need 3 rules for changing them.

Additionally, if you want a notification to be sent to a user when he/she changes the stage, you will need other 3 automation rules for sending such notifications.

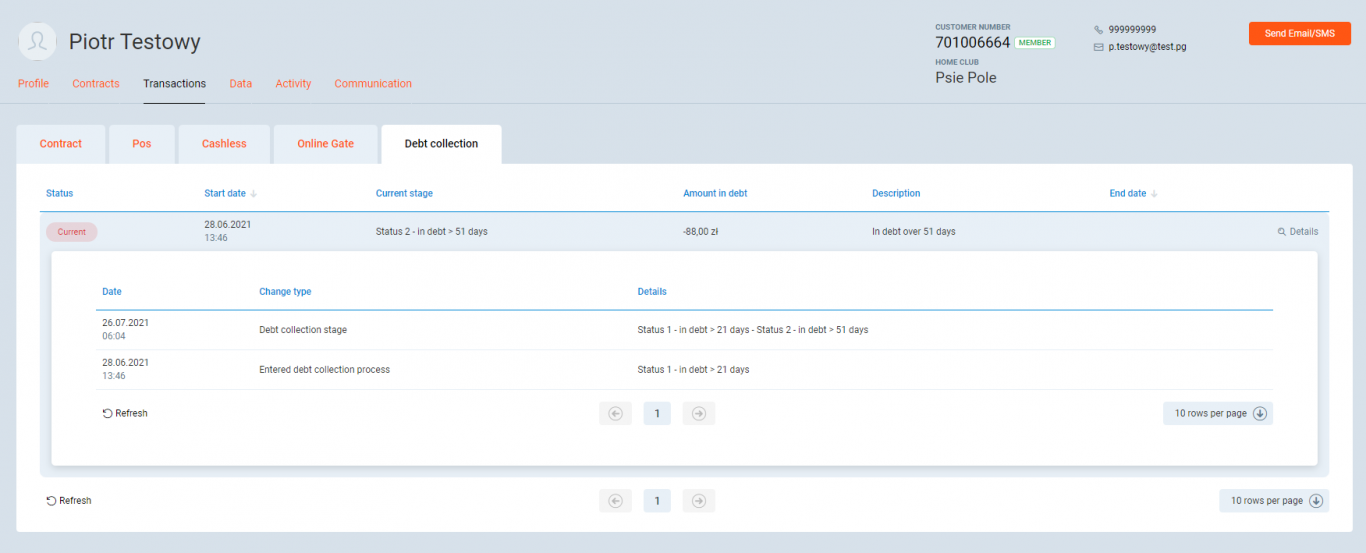

Debt collection history and current stages for user can be tracked on member profile in PGM → Transactions → Debt collection

Instruction

How to add Automation Rules?

1. Go to the PGM → Automation Center → Add automation rule

2. Select one of the following actions:

- Change debt collection stage

- Add Contract Transaction

- Notification

- Exclude a member from recurring payments

- Remove an exclusion member from recurring payments

- Add a note to the user (with an option to block access to the club)

3. Proceed according to the respective instructions below.

Tokens dictionary:

- [NUMBER_OF_DAYS_IN_DEBT] - general number which indicates how long user is in debt (not in debt collection process). Calculated from oldest unpaid transaction. Value should be a positive integer.

- [NUMBER_OF_DAYS_IN_STAGE] - number of days in current debt collection stage. Value should be a positive integer.

- [INTERVALS_IN_DEBT] - number of unpaid contract intervals (counted from overall debts from today's balance)

- [CURRENT_DEBT] - represents the amount of user's debt. Value should be a positive decimal.

- [CURRENT_STAGE] - represents debt collection stage for current process. Value selectable from fixed list of defined stages.

- [DAY_OF_WEEK] - represents the specific day of the week when the user is included in the debt collection stage. Value selectable from fixed list of days (e.g., Monday to Sunday).

- [USER_IS_ALREADY_IN_DEBT_COLLECTION_PROCESS] - indicates if action should be triggered for users that have open debt collection process or not. Value true or false.

- [USER_HOME_CLUB_NAME] - represents the name of the user's home club.

- [PAYMENT_PLAN_NAMES_OF_MEMBERS_ACTIVE_CONTRACTS] - represents the collection of member's payment plan names, associated with the member's active contracts. Value can be selected from a list of available payment plan types in the system. Indicates that an action should be triggered if the member has at least one payment plan with the chosen name on an active contract.

- [PAYMENT_PLAN_TYPES_OF_MEMBERS_ACTIVE_CONTRACTS] - represents the collection of member's payment plan types, associated with the member's active contracts. Value can be selected from a list of available payment plan types in the system. Indicates that an action should be triggered if the member has at least one payment plan with the chosen type on an active contract.

How to change the debt collection stage?

If the configuration is based on a number of days in debt, the date from which this condition is counted is the date of the oldest overdue transaction. But be aware that the date of entering the debt collection process is not equal to a number of days in debt. The date of starting the process will be the date when this condition is met and only then a member becomes a debtor.

Occurrence: This event will be triggered automatically daily by the JobServer

Action: Change debt collection stage

Event: Number of days in debt increased

Available tokens: [NUMBER_OF_DAYS_IN_DEBT], [NUMBER_OF_DAYS_IN_STAGE], [CURRENT_DEBT], [CURRENT_STAGE], [USER_IS_ALREADY_IN_DEBT_COLLECTION_PROCESS], [USER_HOME_CLUB_NAME], [PAYMENT_PLAN_NAMES_OF_MEMBERS_ACTIVE_CONTRACTS], [PAYMENT_PLAN_TYPES_OF_MEMBERS_ACTIVE_CONTRACTS], [INTERVALS_IN_DEBT]

Changing user's debt collection stage can be based on number of days in debt or debt amount or both conditions. Additional value [NUMBER_OF_DAYS_IN_STAGE] allows to check how many days user is in current stage. It can be specifically useful when user's debt collection process was paused and then resumed again. It will assure that the user will stay in particular stage for defined minimum amount of time.

These values are setup as tokens in Conditions section. If we want to specify time range for specific stage, 2 conditions must be added for the same token. The same rule applies if we want to configure stage based only on debt amount, we need lower and upper boundary of range.

It is important that conditions in one automation rule for one stage are not met in the other rule for the other stage. Otherwise user will change debt collections stage multiple times during the same processing (which could for example cause adding penalty transactions twice).

This one event handles both changing the debt collection stage and entering a new process if a member is not already in such. If there is a need to separate automation rules for changing debt collection stage and entering process use token [USER_IS_ALREADY_IN_DEBT_COLLECTION_PROCESS].

There are multiple ways of configuring stage changing.

a) User can change stage both ways.

Examples:

- Profile 1 → Profile 2

- Profile 2 → Profile 4

- Profile 5 → Profile 3

This is the most flexible way of changing stage, but you need to make sure that it fits required business model.

In Action Details, pick debt collections stage to which user should be moved after the above conditions have been met by the user.

In example rule above, each user who is a debtor for 21 to 30 days and has a debt bigger than 200 (currency is the same as defined for the company), will automatically change debt stage for 'Profile 2'. No matter which stage the user was before, nor if he/she has just became a debtor. Also, if the user is not in the debt collection process, he/she will automatically enter the process on 'Profile 2' (skipping 'Profile 1').

b) User can change stage only one way.

Examples:

- None → Profile 3

- Profile 1 → Profile 2

- Profile 2 → Profile 4

In this scenario, we allow the user to "skip" some stages, but only one way. User is not able to go back to previous stage, i.e. form Profile 4 → to Profile 3.

In the example above, each user who is a debtor for 21 to 30 days, and will automatically change debt stage for 'Profile 2', but only if he/she is a debtor on stage below 'Profile 2' or none at all.

c) User can change stage only for the next one.

Examples:

- None → Profile 1

- Profile 1 → Profile 2

- Profile 2 → Profile 3

In this scenario, the user can change stages only in the selected order. In automation conditions above, the user will enter the process on 'Profile 1' only if he/she is not a debtor on any stage and will change the stage to 'Profile 2' only if he/she already has opened the debt collection process and is on stage 'Profile 1'.

To enter a debt collection in this configuration, set condition for 'Profile 1' [USER_IS_ALREADY_IN_DEBT_COLLECTION_PROCESS] to no. For other profiles set the same condition to yes.

How to manually change debt collection stage for user?

There is an option to manually change stage for specified user in User's Profile. Go to Debt Collection tab and for Current process select Change Stage.

To perform this action special system permission is required System administration/ Debt collection/ Change stage. For every manual change a reason should be provided. Be aware that if member still meets the criteria of another debt colletion stage, they will be moved according to the rules defined in the Automation Center.

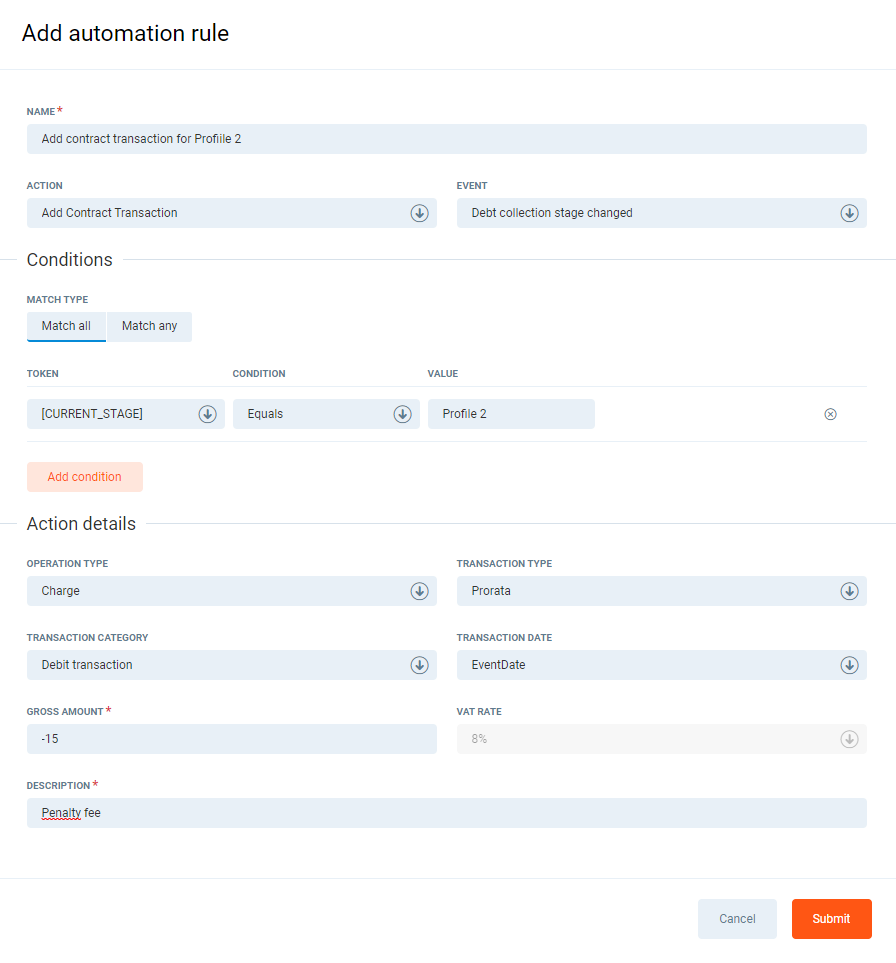

How to add penalty transaction for contract?

Occurrence: This event will be automatically triggered when user changes debt collection stage (must have automation rule for changing stage)

Action: Add contract transaction

Event: Debt collection stage changed

Available tokens: [CURRENT_STAGE], [CURRENT_DEBT], [USER_AGE], [USER_FIRST_NAME], [USER_LAST_NAME], [USER_NAME], [USER_HOME_CLUB_NAME], [PAYMENT_PLAN_NAMES_OF_MEMBERS_ACTIVE_CONTRACTS], [PAYMENT_PLAN_TYPES_OF_MEMBERS_ACTIVE_CONTRACTS]

- (Required) Set [CURRENT_STAGE] equals to desired stage to which after user enters, a penalty transaction will be added to his/her contract.

- (Optional) Set [CURRENT_DEBT] for an amount range (two conditions) if you wish to add penalty transaction only if a user reaches a certain debt.

Fill all fields in Action Details section about the type of transaction. For now only Charge and Charge cancellation transactions are available. A new debit transaction will be added to user’s contract with Transaction Date equals to date of changing debt collection stage, which is EventDate.

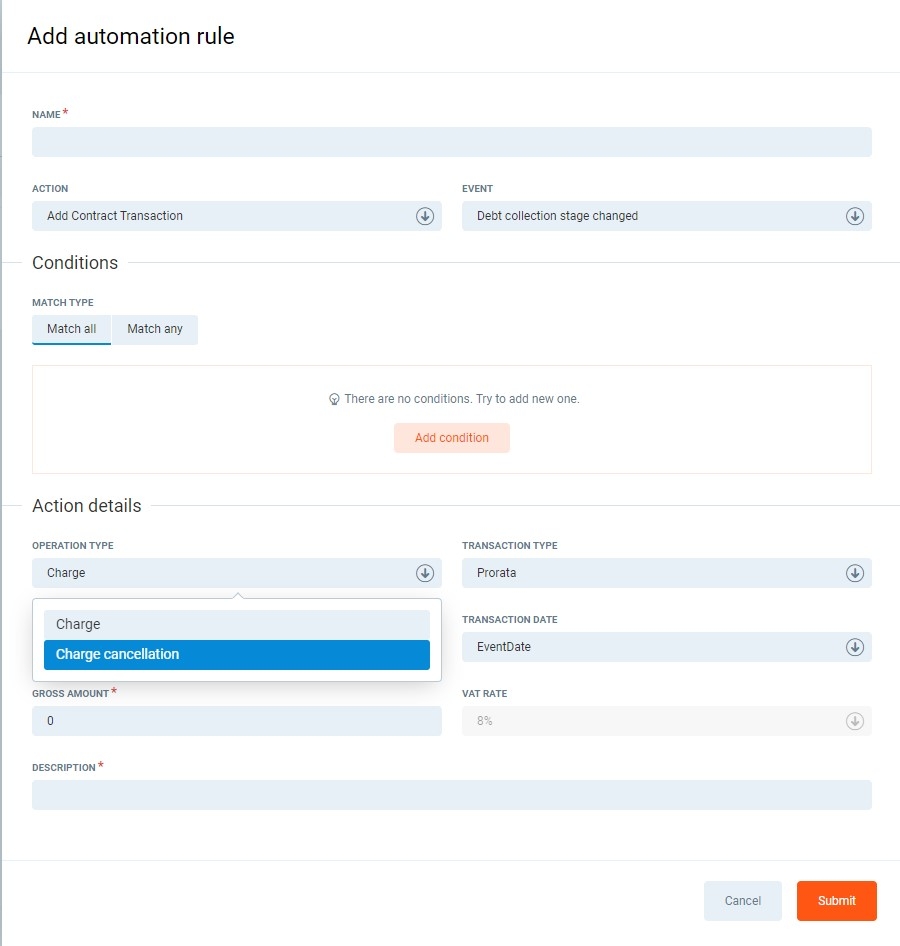

How to perform a debt write-off?

Occurrence: This event will be automatically triggered when user changes debt collection stage (must have automation rule for changing stage)

Action: Add contract transaction

Event: Debt collection stage changed

Operation type: Charge cancellation

Available tokens: [CURRENT_STAGE], [CURRENT_DEBT], [USER_AGE], [USER_FIRST_NAME], [USER_LAST_NAME], [USER_NAME],[USER_HOME_CLUB_NAME], [PAYMENT_PLAN_NAMES_OF_MEMBERS_ACTIVE_CONTRACTS], [PAYMENT_PLAN_TYPES_OF_MEMBERS_ACTIVE_CONTRACTS]

- (Required) Set [CURRENT_STAGE] equals to desired stage to which after user enters, a penalty transaction will be added to his/her contract.

- (Optional) Set [CURRENT_DEBT] for an amount range (two conditions) if you wish to add penalty transaction only if a user reaches a certain debt.

A new credit transaction will be added to user’s contract with Transaction Date equals to date of changing debt collection stage, which is EventDate.

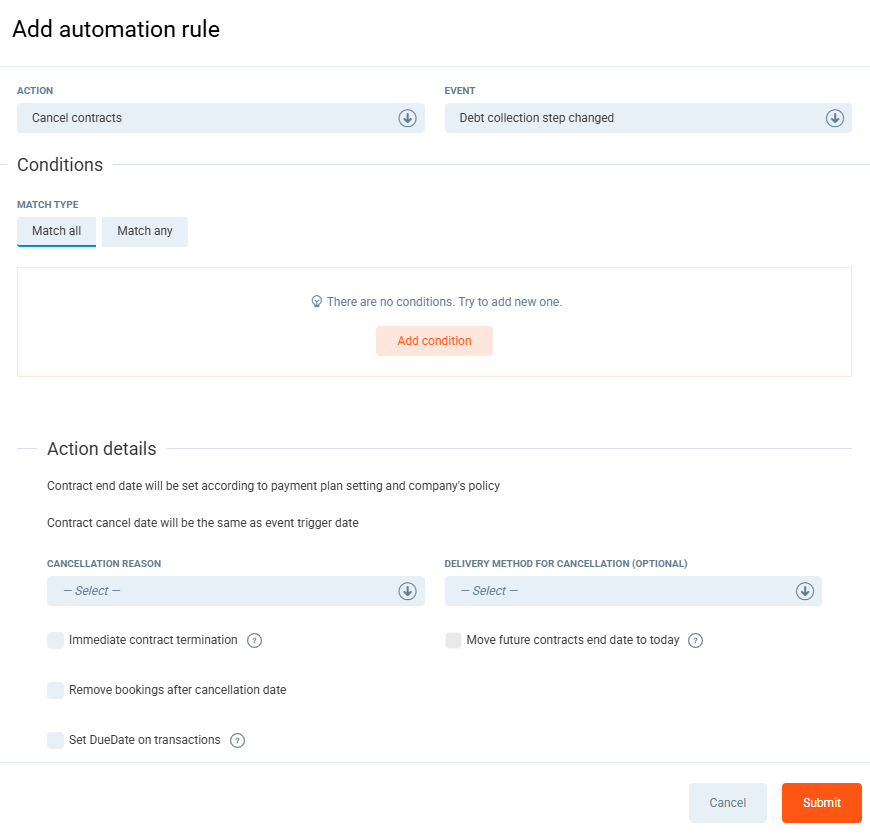

How to cancel all contracts?

Occurrence: This event will be automatically triggered when user changes debt collection stage (must have automation rule for changing stage) or exits the debt collection process

Action: Cancel contracts

Event: Debt collection stage changed, Debt collection process exited

Available tokens: [CURRENT_STAGE], [CURRENT_DEBT], [USER_AGE], [USER_FIRST_NAME], [USER_LAST_NAME], [USER_NAME],[USER_HOME_CLUB_NAME], [PAYMENT_PLAN_NAMES_OF_MEMBERS_ACTIVE_CONTRACTS], [PAYMENT_PLAN_TYPES_OF_MEMBERS_ACTIVE_CONTRACTS]

This action performs cancellation of all contracts for members that meet the criteria set in "Conditions" section. Only contracts which are not ended, not cancelled and are currently active will be affected. Cancellation reason must be selected in action parameters. Delivery method is optional. User can also choose if all bookings after cancellation date should be removed and if contracts signed for different early termination fee policy should be ignored.

If you wish to override the transaction due date, you can select the Set DueSate on transactions checkbox. Enabling this will automatically set the transaction due date to today's date.

Additionally, you can modify the default cancellation policy and cancel the contract immediately after the selected debt collection stage. Use Immediate contract termination if you want to cancel the contract on the same day the event trigger occurs, or Move future contract end date to today if you wish to change the future end date to the event trigger date.

This feature is available from the R.93 system version.

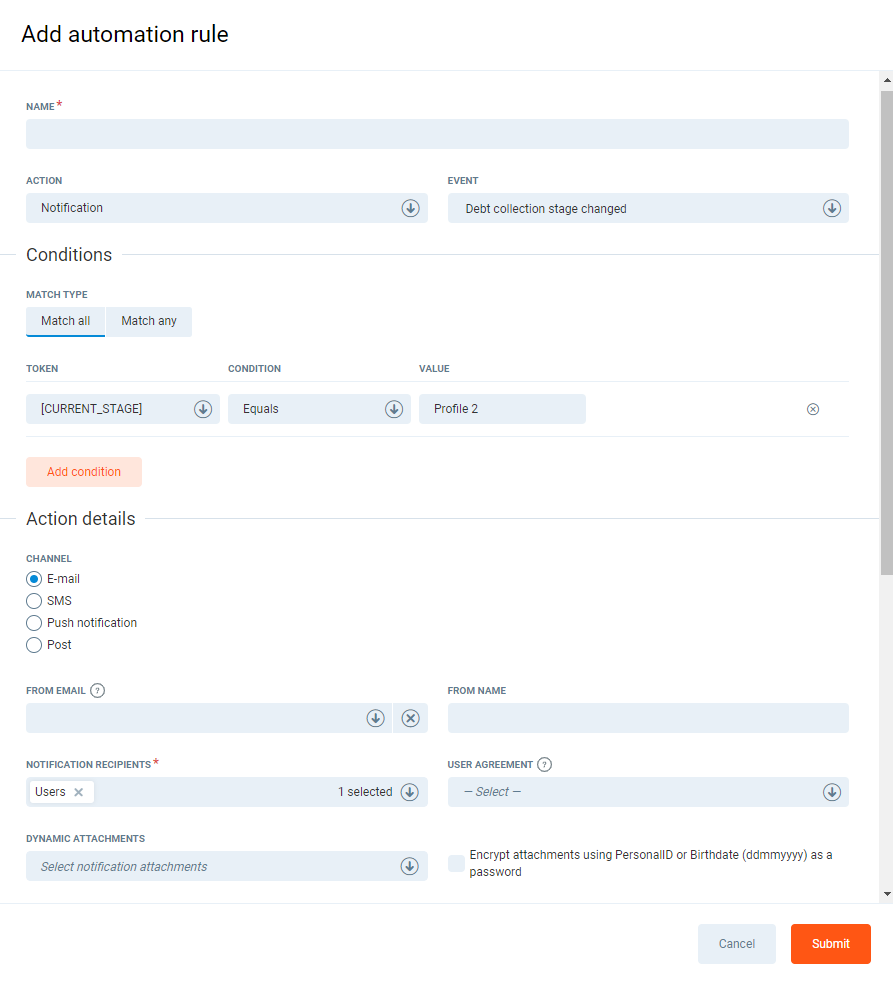

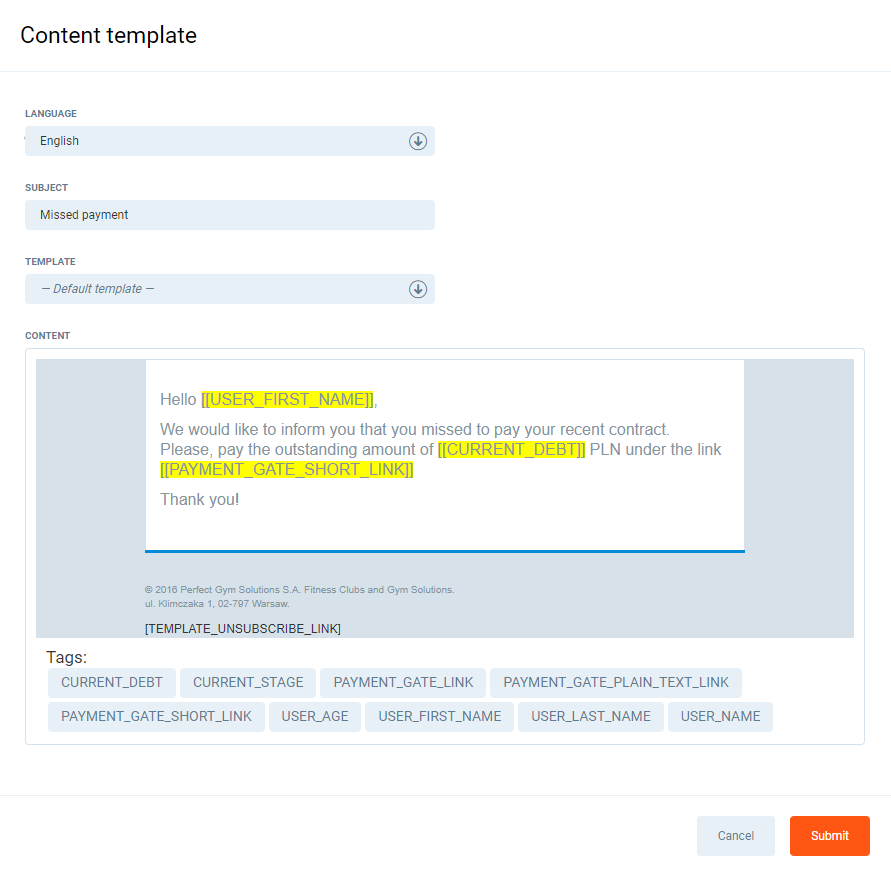

How to send notifications?

Occurrence: This event will be automatically triggered when user changes debt collection stage (must have automation rule for changing stage)

Action: Notification

Event: Debt collection stage changed, Debt collection process exited

Available tokens: [CURRENT_STAGE], [CURRENT_DEBT], [USER_HOME_CLUB_NAME],

[PAYMENT_PLAN_NAMES_OF_MEMBERS_ACTIVE_CONTRACTS], [PAYMENT_PLAN_TYPES_OF_MEMBERS_ACTIVE_CONTRACTS]

This action is no different than setting any notification rule in AC, but with additional conditions as tokens. For example, set a notification as email to inform users that they entered debt collection process. You can add a custom message for each stage with tokens or if you do not add any Conditions the same message will apply to every single stage.

You can also add tokens to message, which later will be replaced with corresponding values, for example: current amount of debt, debt collection stage or a link to payment gateway that will allow user to pay the debt straight from there.

Even though there is no AC rule to exit debt collection process, you can still send notifications with this action through AC with event Debt collection process exited.

How to block contract payments?

Use "Block contract payments" action. It will prevent member from paying and club employees from getting payments for member's contract.

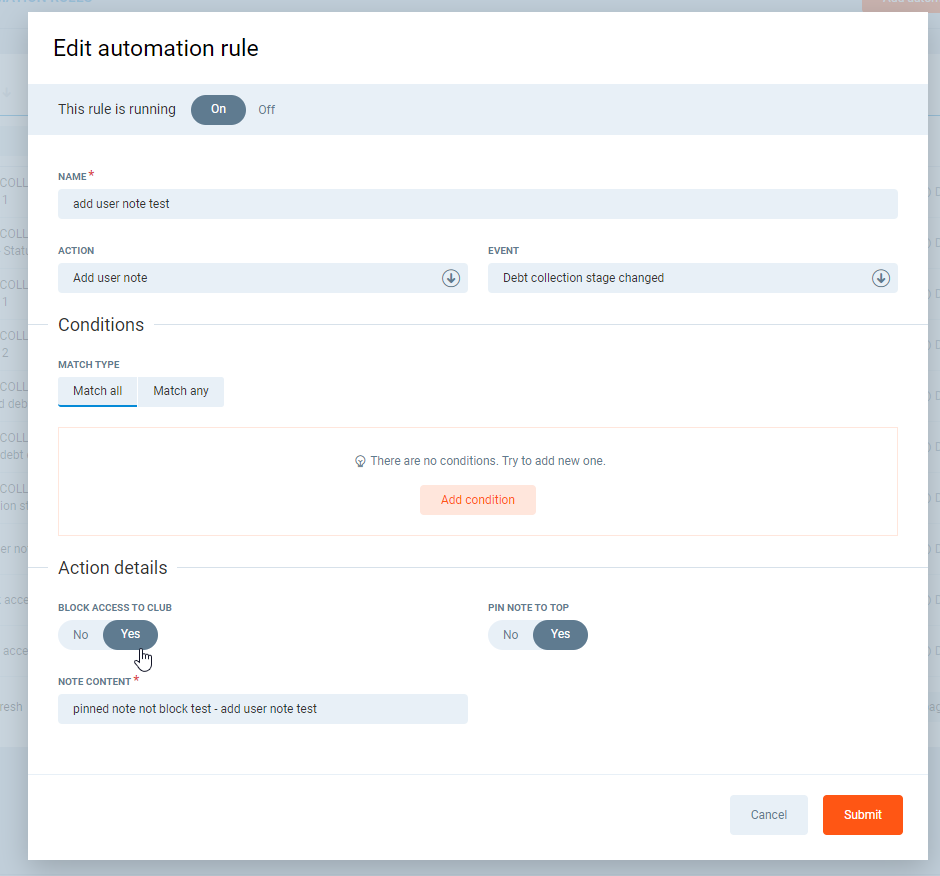

How to add a note to the user (with an option to block access to the club)?

Occurrence: This event will be automatically triggered when user changes debt collection stage (must have automation rule for changing stage)

Action: Add user note

Event: Debt collection stage changed, Debt collection process exited

Available tokens: [CURRENT_STAGE], [CURRENT_DEBT], [USER_HOME_CLUB_NAME],

[PAYMENT_PLAN_NAMES_OF_MEMBERS_ACTIVE_CONTRACTS], [PAYMENT_PLAN_TYPES_OF_MEMBERS_ACTIVE_CONTRACTS]

This action allows you to automatically add a note to the user profile. This Action has same capabilities as adding notes in Member Profile manually.This feature also allows you to block an access to the club.

How to exit debt collection process

There is no manual configuration for exiting debt collection process. All users that have opened process and already payed the debt will be removed automatically from debtors list and will be no longer included in next processing. There are no other conditions that have to met in order to exit the process.

How to pause debt collection process for member?

There is a possibility to periodically exclude a member from debt collection process even tho a user should be processed. To do this an employee needs additional system permission System administration/ Debt collection/ Pause debt collection process (more about permissions). A new option on member profile should be visible only for current debt collection process.

When pausing the process, two parameters can be added: end date of pause and reason. It is a good practice to always provide a reason for change, although it is not obligatory. If end date of pause is added, then the user after reaching that date either will exit debt collection process if debt is being paid or will get back into processing. If end date is not provided, member will be excluded form processing until an employee will manually resume the process again.